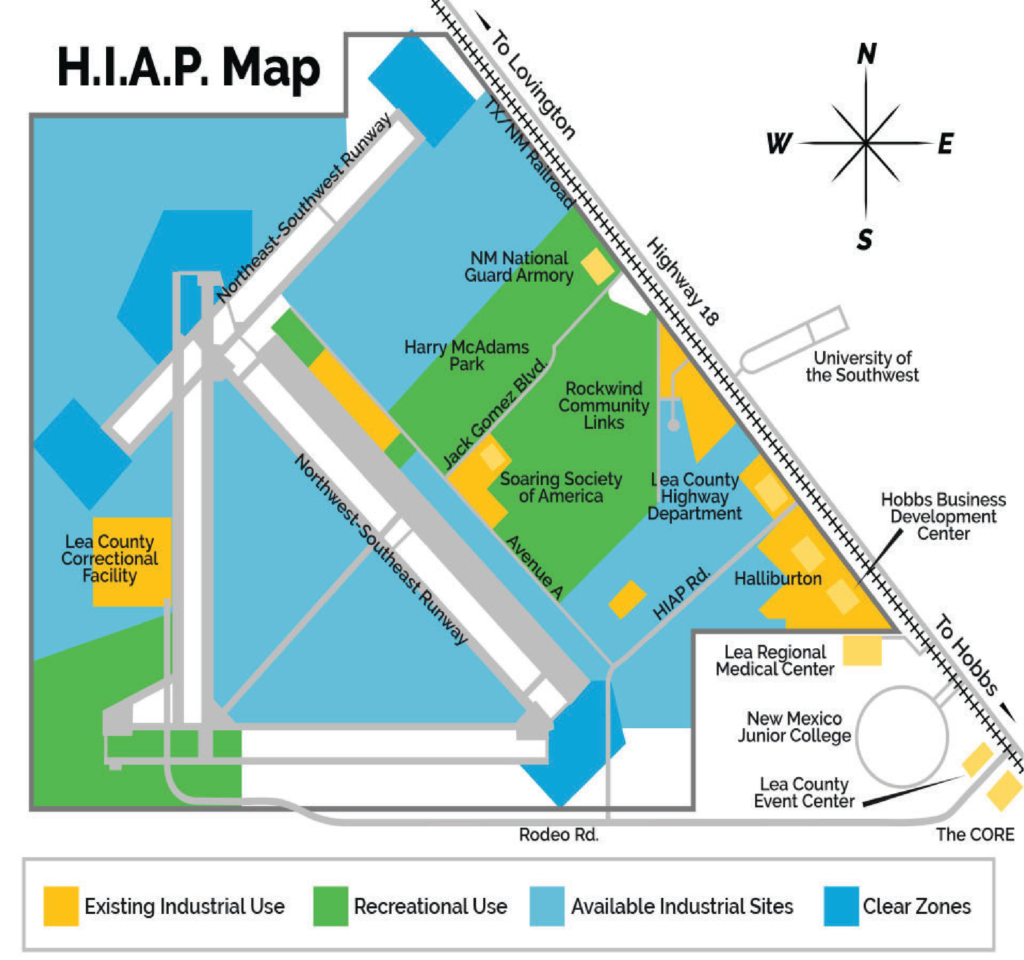

Located on NM Hwy 18, in Hobbs, HIAP has a total of 3,000 acres with 1,000 acres for development and 90 acres with full infrastructure. There is no zoning, except for city protective covenants and available, shovel-ready sites for light industrial have full infrastructure, including telecommunications and access to rail.

- Completed HUD Approved NEPA

- Infrastructure includes Electricity, Water, Sewer, and Natural Gas

- Rail Access: New Mexico & Texas Railway (TXN)

- Distance to nearest major highway: 0 miles to NM 18; 5 miles to US 62-180

- Nearest 4-lane major highway: NM 18 and US 62-180

- Distance to nearest airport: 5 miles, Lea County Regional Airport

INCENTIVES AVAILABLE FOR DEVELOPMENT AT HIAP FROM THE CITY OF HOBBS

The Local Economic Development Act (LEDA) allows communities to provide assistance to qualified economic development projects while maintaining safeguards against the unauthorized use of public resources. The purpose of the Act is to allow municipalities and counties to enter into Joint Powers Agreements to plan and support regional economic development projects.

LEDA can be used to support 3 types of projects: Infrastructure/Improvement, Economic Development (Job Creator) and Retail. Project funds can be used for:

- The purchase, lease, grant, construction, reconstruction, improvement or other acquisition or conveyance of land, buildings or other infrastructure

- Public works improvements essential to the location or expansion of a qualifying entity

- Loan guarantees securing the cost of land, buildings or infrastructure in an amount not to exceed the revenue that may be derived from the municipal infrastructure gross receipts tax or the county infrastructure gross receipts tax

INCENTIVES AVAILABLE FOR DEVELOPMENT AT HIAP FROM LEA COUNTY

Industrial revenue bonds may be issued to finance privately-operated and developed projects by a municipality, county, or the New Mexico Finance Authority. The private party initiates the process by requesting that the government unit issue the bonds (a political process done in accordance with local and state laws). IRBs can be issued for projects over $3 million dollars.

IRBs offer property and gross receipts tax relief to a company. Tangible personal property (other than building materials and related construction services) purchased with IRB proceeds is deductible for gross receipts tax purposes because it is being sold to a government purchaser. IRBs of $10 million or less issued to finance manufacturing facilities may also be eligible for exclusion of interest from gross income for federal income tax purposes (effectively lowering the interest rate on the IRBs).

MARKET RATE

A fair-market rate must be established for each property within the city-owned HIAP industrial park. The City of Hobbs may elect to reduce/eliminate the price of parcels within the park that qualify for LEDA incentives. Based on recent comparable sale data, the price per acre for non-LEDA eligible projects is approximately $40,000 per acre.

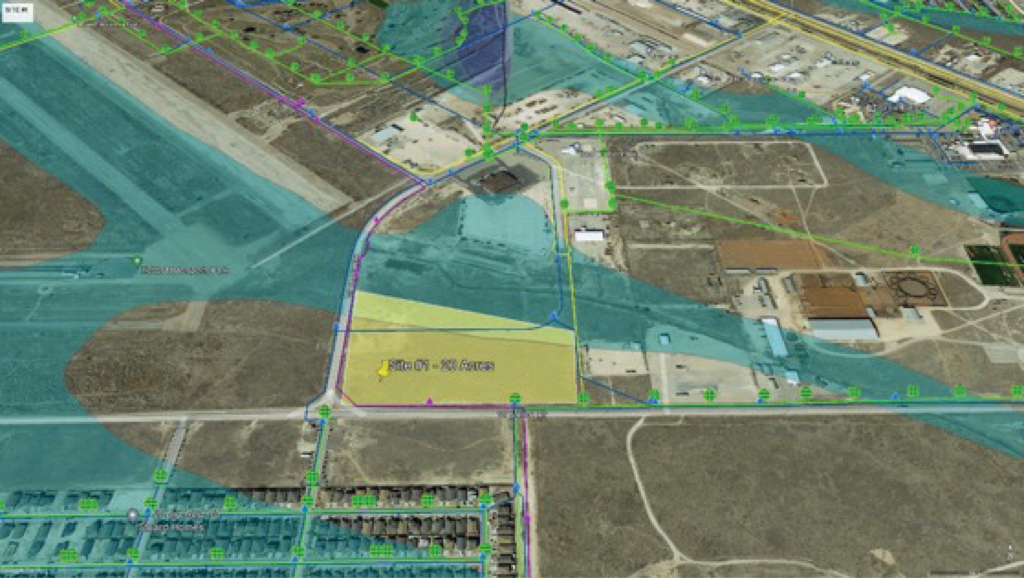

SITE #1: 20 ACRES @ FAIR MARKET RATE $800,000

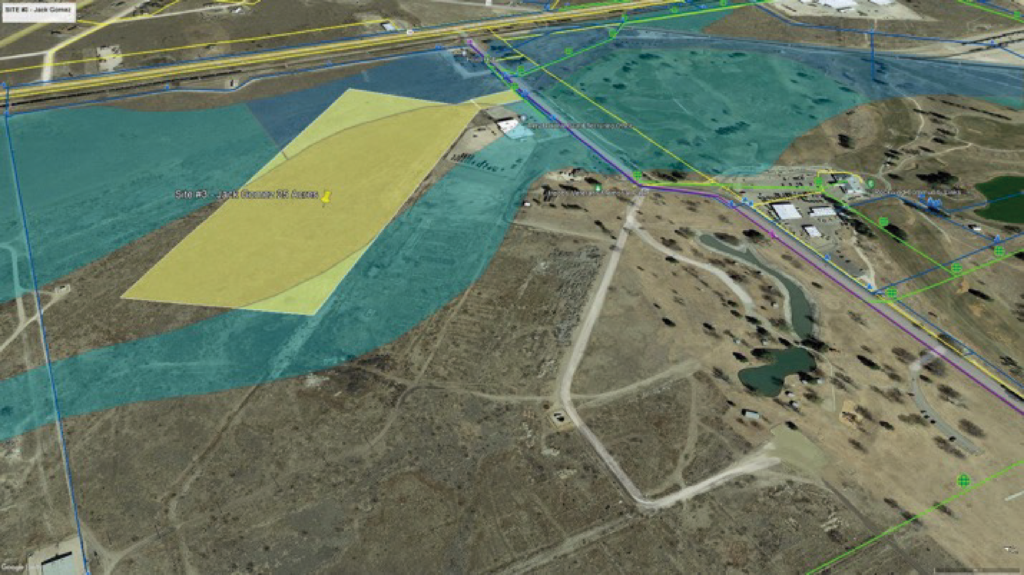

SITE #2: 30 ACRES @ FAIR MARKET RATE $1,200,000

SITE #3: 25 ACRES @ FAIR MARKET RATE $1,000,000